Credit score required by lenders for a home loan varies by lender and loan type. You don’t have to be perfect; you just need a realtor and lender that works with you.

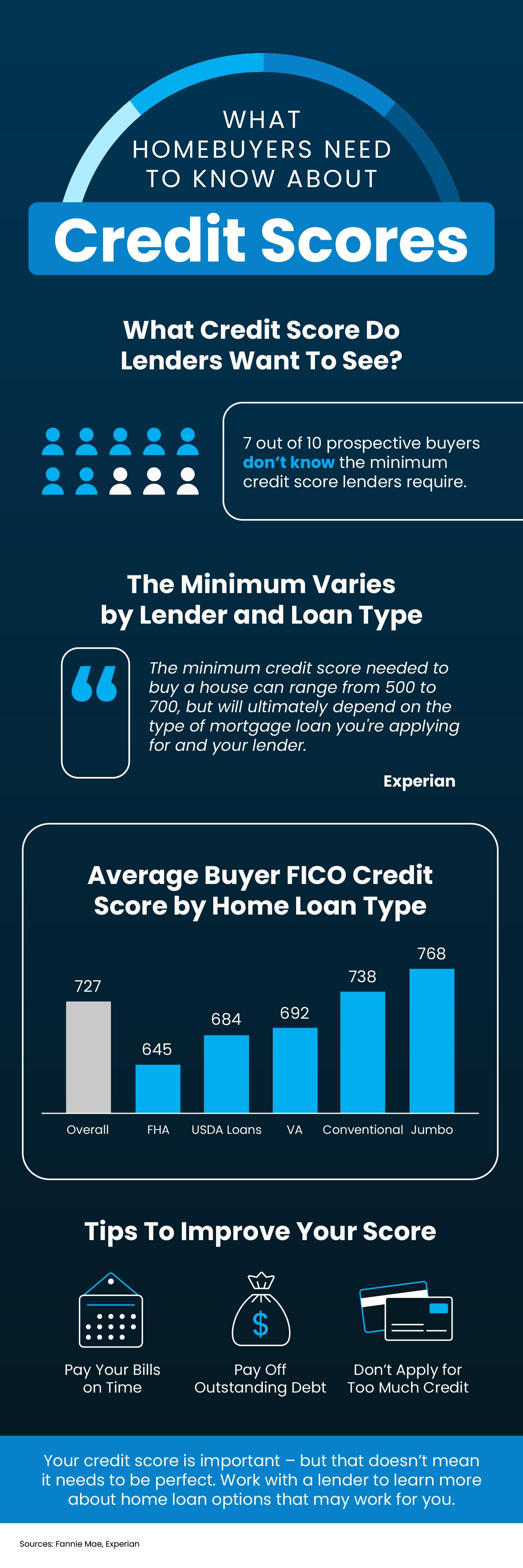

What Homebuyers Need To Know About Credit Scores

Some Highlights

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

About the Author

Jennifer Louden

The big question....

What can I do for you that is different than any other Realtor or Real Estate Broker? The answer is Personal Service.

I will work for you, at your comfort level, not pressuring you to look at, or buy homes that you are not interested in. Buyers, I will not entice you to overspend and be house poor. Sellers, you always choose your selling price. I will inform you of the current market and the trends that I see. I never make choices for you. I inform. All decisions are yours to make. I am only an extension of you, doing as you instruct. I will call you, text you or email you on a time schedule that you would prefer. Frequently if you desire; or not, depending on your requests. I will be working for you; and with you, doing my very best at all times.

My name is Jennifer Louden and I really enjoy helping you.