Homeowner’s insurance is essential to protect your biggest investment – your home. While it’s unpleasant to think about worst-case scenarios, the right coverage acts as your safety net. When buying a home, remember to budget for homeowner’s insurance along with your mortgage payment. It offers significant protection against the unexpected.

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you.

- Covers Repairs and Rebuilding Costs: If your home is damaged by fire, storms, or other covered events, your policy helps pay for repairs or even a full rebuild.

- Protects Your Belongings: Many policies can also cover personal items like furniture, electronics, and clothing if they’re stolen or damaged.

- Provides Liability Coverage: If someone gets injured on your property, homeowner’s insurance can help cover medical bills or legal expenses.

In the simplest sense, it gives you peace of mind. Knowing you have protection against unexpected events helps you worry less. And with such a big purchase, having that reassurance is a big deal.

And while your first insurance payment will be wrapped into your closing costs, you’ll want this to be a part of your budget beyond closing day too. That’s because it’s a recurring expense you’ll have once you get the keys to your home.

Here’s what you need to know to help you budget for this important part of homeownership today.

Costs and Claims Are Rising

In recent years, insurance costs have been climbing. According to Insurance.com, there are four big reasons behind the jump in premiums:

- More severe weather events and wildfires are leading to higher claims.

- Insurance companies are pulling out of high-risk areas, reducing options for homeowners in some states.

- Past rate increases haven’t kept up with the rise in claims.

- The cost to rebuild or repair homes has gone up due to higher material and labor costs.

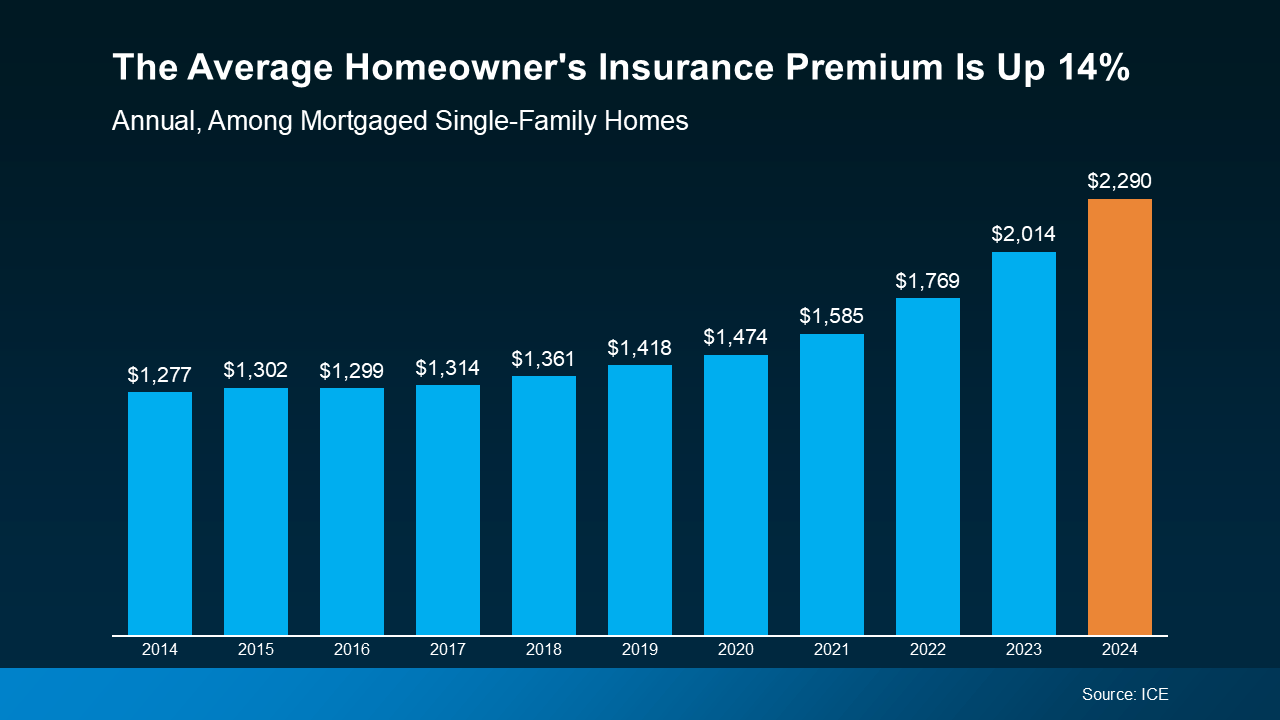

Basically, disasters are happening more often, repairs cost more, and insurers have to adjust their rates to keep up. Data from ICE Mortgage Technology helps paint the picture of how the average yearly premium has climbed over the last decade (see graph below):

What You Can Do About It

Homeowner’s insurance is a must to protect your home and your investment. But with costs rising, you’ll want to do your homework to balance the best coverage you can get at the best price possible.

Homeowner’s insurance rates vary widely based on location, provider, and coverage. Shop around and compare quotes before settling on a policy. And don’t forget to ask about discounts. Things like security systems or bundling with auto insurance could help lower your insurance costs.

Bottom Line

When you’re planning to buy a home, it’s important to look beyond just your mortgage payment. You’ll also want to budget for your homeowner’s insurance policy. It gives you a lot of protection against the unexpected. And while it’s true those costs are rising, there are things you can do to try to get the best price possible.

What’s your biggest concern when it comes to budgeting for homeownership? Let’s talk through it and make sure you’re set up for success.

About the Author

Jennifer Louden

The big question....

What can I do for you that is different than any other Realtor or Real Estate Broker? The answer is Personal Service.

I will work for you, at your comfort level, not pressuring you to look at, or buy homes that you are not interested in. Buyers, I will not entice you to overspend and be house poor. Sellers, you always choose your selling price. I will inform you of the current market and the trends that I see. I never make choices for you. I inform. All decisions are yours to make. I am only an extension of you, doing as you instruct. I will call you, text you or email you on a time schedule that you would prefer. Frequently if you desire; or not, depending on your requests. I will be working for you; and with you, doing my very best at all times.

My name is Jennifer Louden and I really enjoy helping you.